Forex Market Economic Calendar for Tuesday, May 15, 2018

The forex market economic calendar today has several important economic data related to the economies of Germany, Eurozone, UK, US, Canada and Japan, with a focus on the GDP Growth Rate in Germany, Eurozone and Japan. Moderate to high volatility is expected for the Euro, the Japanese Yen and the US Dollar and price action which could move the market may be evident both in the European Session and later in the American Session.

Key economic events for today in the forex market to focus on:

European Session

- Germany: GDP Growth Rate QoQ Flash, GDP Growth Rate YoY Flash, ZEW Current Conditions, ZEW Economic Sentiment Index, Norway: GDP Growth Rate QoQ and YoY, Eurozone: Meeting on Iran, Industrial Production MoM and YoY, ZEW Economic Sentiment Index, GDP Growth Rate YoY 2nd Estimate, UK: Average Earnings Including Bonus, Unemployment Rate, Claimant Count Change, Employment Change

Time: 06:00 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT

The Eurozone GDP Growth Rate and the Industrial Production can either provide some support for the Euro or continue its recent decline against other currencies, especially against the US Dollar. Higher than expected or rising figures for both the GDP Growth Rate and the Industrial Production in the Eurozone are considered positive for the Euro reflecting increased economic growth and expansion in the industrial sector.

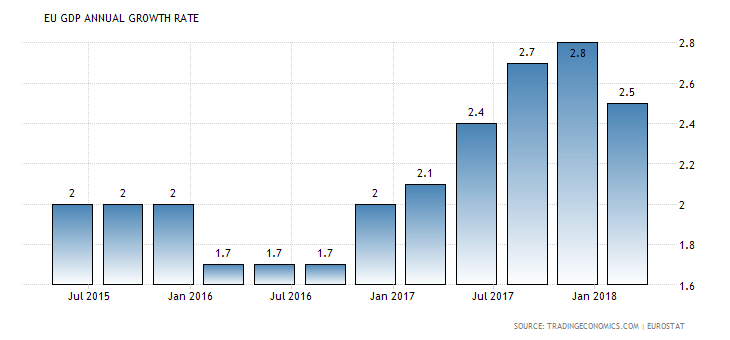

The forecast is for an increase for the Industrial Production both monthly and yearly, but a decline for the GDP Growth Rate both quarterly and yearly. The forecast is for a GDP Growth Rate YoY of 2.5%, lower than the previous rate of 2.8% and a GDP Growth Rate QoQ of 0.4%, lower than the previous rate of 0.7%. As seen from the chart the GDP Growth Rate in the Eurozone is trending up as of January 2017 and the level of 2%.

Higher than expected readings for the ZEW Economic Sentiment index in the Eurozone and Germany, the ZEW Current Conditions in Germany and GDP Growth Rate in Germany are also considered positive and supportive for the Euro, reflecting optimism about six-months expectations concerning the economy, inflation rates, and interest rates, plus higher economic growth in Germany.

The forecast is for a decline of the GDP Growth Rate in Germany both quarterly and yearly, a higher than expected ZEW Economic Sentiment Index for the Eurozone and a lower than expected ZEW Current Conditions Index for Germany. Overall mixed economic data is expected for the Euro which may add volatility if there are any significant positive or negative economic surprises.

The British Pound can move with the release of important economic data, the Average Earnings Including Bonus, Unemployment Rate, Claimant Count Change, and Employment Change.

Increased figures for the and Employment Change and the Average Earnings Including Bonus and decreased figures for the Unemployment Rate and Claimant Count Change are considered positive and supportive for the British Pound, reflecting a strong labor market and increased consumer spending power, which can lead to higher economic growth.

The Unemployment Rate in UK is expected to remain unchanged at 4.2%, but the expectations are for positive economic data related to the labor market., with an increase for the Employment Change and a figure of 130K, higher than the previous figure of 55k and a decline for the Claimant Count Change having a reading of 7.5k, lower than the previous reading of 11.6K.

American Session

- US: NY Empire State Manufacturing Index, Retail Sales, Business Inventories, NAHB Housing Market Index, Fed Williams Speech

Time: 12:30 GMT, 14:00 GMT, 17:10 GMT

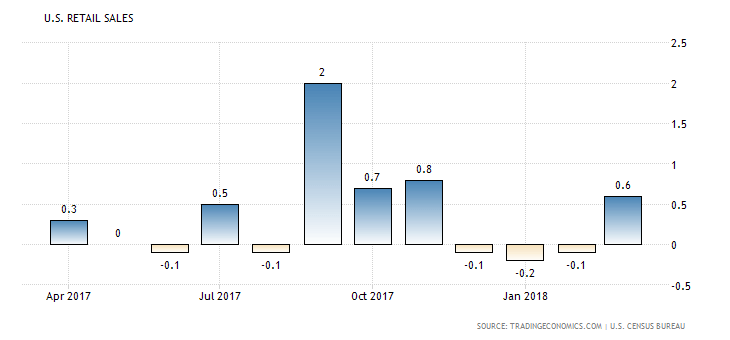

The US monthly Retail Sales are expected to decline having a figure of 0.3%, lower than the previous figure of 0.6%. Higher readings are considered positive for the US Dollar, reflecting higher consumer spending, a key driver of higher economic growth.

As seen from the chart the monthly US Retail Sales are very volatile with an undefined trend for the past 12-months.

Lower than expected readings for the Business Inventories and higher readings for the NY Empire State Manufacturing Index and the NAHB Housing Market Index should be considered positive for the US Dollar, reflecting a strong consumer demand for goods held by manufacturers, wholesalers, and retailers and a favorable outlook on home sales.

Pacific Session

- Australia: RBA Meeting Minutes, RBA Assistant Governor Debelle Speech

Time: 01:30 GMT, 01:40 GMT

The minutes of the Reserve Bank of Australia meetings can move the Australian Dollar providing insights and views on the monetary policy and the economic conditions, mainly the inflation rate and economic growth. Statements pointing at a monetary policy change due to concerns about the inflation rate may increase the probabilities of future interest rate increases, which is a positive factor for the Australian Dollar.

Asian Session

- Japan: GDP Growth Rate QoQ and Annualized

Time: 23:50 GMT

The GDP Growth Rate is one of the most important economic indicators related to the economic performance of any country. Higher than expected figures for the GDP Growth Rate are considered positive for the local economy and currency.

The forecast for Japan is a quarterly GDP growth Rate of 0.1%, lower than the previous figure of 0.4% and an annualized GDP Growth Rate of 0.1% for the first quarter, lower than the previous figure of 1.6%. These figures should be considered negative and could result in the depreciation of the Japanese Yen against other currencies upon their release, reflecting economic slowdown

Comments

Post a Comment