Forex Market Economic Calendar for Wednesday, May 16, 2018

Important economic news related to the Eurozone, the Inflation Rate in Germany and in the Euro-area should move the Euro today, after the important economic data of GDP Growth yesterday. Any soft data on the Inflation Rate in the Eurozone will lower bets on ECB changing its monetary policy in 2018. There are economic releases that have the potential to move also the US and the Australian Dollar, and the Japanese Yen. Overall moderate to high volatility is expected mostly for the Euro versus other currencies.

Key economic events to focus on today in the forex market:

European Session

- Germany: Inflation Rate YoY Final, France: IEA Oil Market Report, Eurozone: ECB Non-Monetary Policy Meeting, Inflation Rate MoM, Core Inflation Rate YoY Final, Inflation Rate YoY Final, ECB President Draghi Speech, ECB Coeure Speech, ECB Praet Speech, Switzerland: SNB Chair Jordan Speech

Time: 06:00 GMT, 08:00 GMT, 09:00 GMT, 12:00 GMT, 12:30 GMT, 14:30 GMT, 16:00 GMT

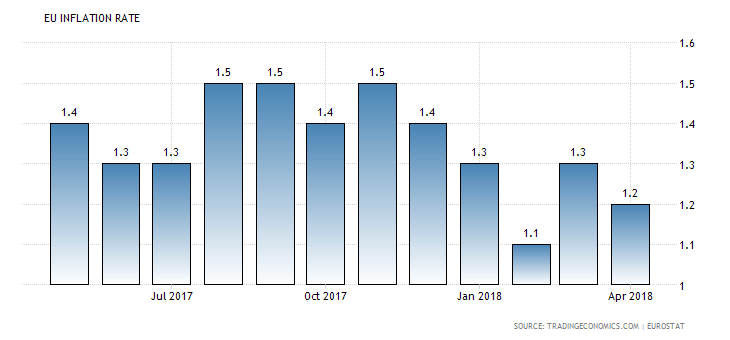

“The Eurozone consumer price inflation is expected to slow to 1.2 percent year-on-year in April 2018 from the previous month’s 1.3 percent, and below market expectations of 1.3 percent.”, Source: Trading Economics

In 2018 we notice that the Inflation Rate in Eurozone has been in a tight range of Low/High readings 1.2%-1.3%, and has been declining compared to year 2017, reflecting that there are not any real inflationary pressures in the Euro-area. This means that the ECB has not any economic motivation to start tightening the monetary policy raising the key interest rate, a negative factor for the Euro.

The yearly Core Inflation Rate in the Eurozone is also expected to decline at 0.7%, lower than the previous figure of 1%, while the yearly Inflation Rate in Germany is expected to remain unchanged at 1.6%, a neutral fundamental factor for the Euro. There are several Speeches from Central banks officials, both related to the Euro and the Swiss Franc, which may influence the mentioned currencies with any updated information and statement son economic conditions, inflation or economic growth.

American Session

- US: Housing Starts, Building Permits, Fed Bostic Speech, Industrial Production, EIA Crude Oil Stocks Change, Fed Bullard Speech

Time: 12:30 GMT, 13:15 GMT, 14:30 GMT, 22:30 GMT

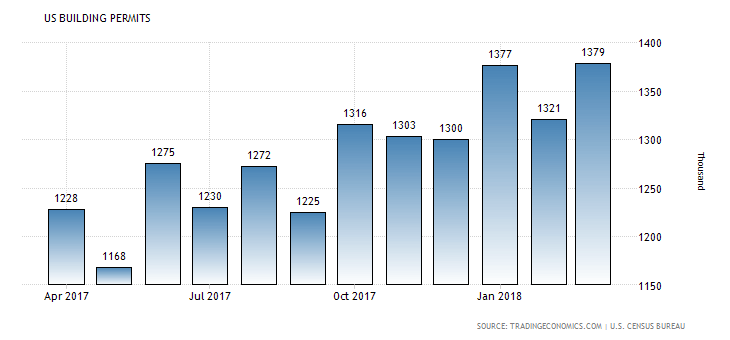

Higher than expected or increasing figures for the Housing Starts and Building Permits in US are considered positive and supportive for the US Dollar, reflecting a robust housing market, a leading indicator of the broader economy. The chart shows that for the past 12-months the trend for the Building Permits in the US is an uptrend, but with a lot of volatility.

The forecast is for a figure of -1.2%, lower than the previous figure of 4.4%, which was previous revised from 2.5%. An increase in the reading for the Housing Starts and the Industrial Production, both monthly and yearly is expected, which should be supportive for the US Dollar reflecting a strong industrial sector.

The EIA Crude Oil stockpiles report may add increased volatility for the oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: AUD Westpac Consumer Confidence, Wage Price Index

Time: 01:30 GMT

Increasing figures for the Consumer Sentiment Index, and the Wage Price Index are considered positive for the Australian Dollar, reflecting views on economic conditions. A high level of confidence is considered a leading indicator for the consumer spending and the broader economy. Higher levels of wages increase the consumer spending power and add inflationary pressures due to strong demand for goods and services, positive factors for the local economy and the currency.

Asian Session

- Japan: Machinery Orders MoM

Time: 23:50 GMT

Higher than expected or increased figures for Machinery Orders are considered positive and supportive for the Japanese Yen, measuring the machinery orders placed at major manufacturers and being a leading indicator for business confidence and spending, with positive effects on employment as well. The forecast is for a figure of -1.4%, lower than the previous figure of 2.1%, which most probably may influence negatively the Japanese Yen.

Comments

Post a Comment